Australia’s Electro Optic Systems (EOS) is poised to make a significant strategic shift, with its CEO, Andreas Schwer, revealing to Reuters that the company is “very likely” to relocate its headquarters and stock market listing from Australia to Europe within the next year. This move aims to capitalise on the burgeoning European defence market, driven by heightened security concerns and substantial increases in defence spending.

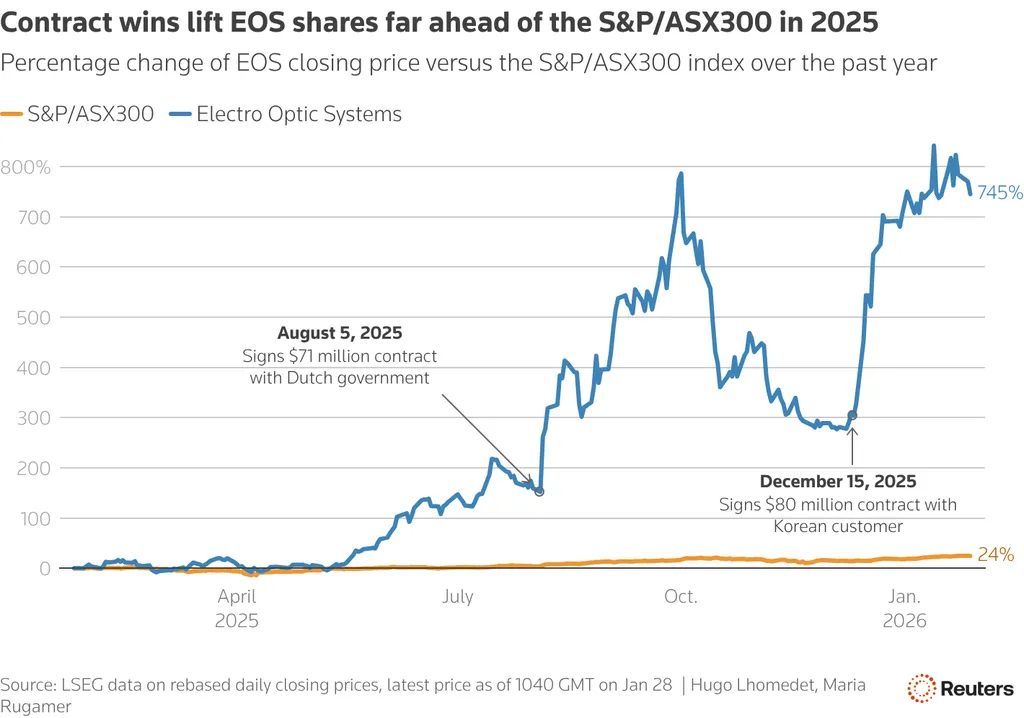

EOS made headlines in August 2025 when it secured the world’s first export contract for a 100-kilowatt-class laser weapon, a €71 million ($85 million) deal with the Netherlands. This success has positioned EOS as a key player in the defence sector, particularly in the realm of drone-defence technology. Schwer anticipates numerous similar opportunities as European nations prioritise sovereign military capabilities and intellectual property control.

The decision to relocate is expected to be finalised in the first half of 2026, with Germany and the Netherlands as the leading contenders for the new base. Schwer highlighted that the choice will hinge on long-term framework agreements with the host country. The relocation process, which requires no regulatory approval, is anticipated to be completed by the end of 2026, with the relisting potentially occurring in early to mid-2027.

EOS is already establishing production and engineering facilities in Germany and is in discussions with ten European governments regarding future orders. The economic advantages of high-energy laser systems over traditional missile-based defence are significant. Destroying small drones with missiles can cost tens of thousands of euros per shot, whereas high-energy laser systems can achieve the same result for as little as one to ten euros. This cost efficiency is reshaping air-defence strategies as drone threats become more prevalent.

“There is no noise, no gunshot, no light. It simply causes the drone to fall from the heavens from a huge energy impact that makes it melt down,” Schwer explained, underscoring the effectiveness of laser technology.

Despite their potential, high-energy lasers are not yet fully battle-tested. Environmental factors such as rain, fog, and dust can significantly degrade their effectiveness, and their substantial cooling and energy demands pose challenges for frontline use.

Control of intellectual property (IP) is emerging as a critical issue in Europe’s defence build-up. Anticipated export curbs on U.S. laser systems exceeding 50 kW underscore the urgency for Europe to develop its own capabilities. “We have not seen any client who told us they don’t mind where you produce and where the IP is sitting. Those times are gone,” Schwer said. EOS, which owns all its IP and benefits from Singapore’s flexible export rules, is well-positioned to transfer its technology to clients.

Amid escalating security threats from Russia’s war in Ukraine, EOS’s relocation highlights Europe’s technological gap and its determination to reduce dependence on the U.S. While the U.S. and China have already fielded laser demonstrators with combat units, Europe’s high-energy laser programmes remain largely in prototype or research and development stages. EOS is developing a 300 kW laser system, which it claims would allow it to shoot down missiles, rockets, and drones.

Germany’s Rheinmetall and European missile maker MBDA have demonstrated a 20 kW naval laser system in sea trials, while France’s Cilas has tested a 2 kW system against small drones. Rheinmetall plans to start series production of its laser weapon systems earlier than initially planned, reflecting the urgent need for advanced defence technologies in Europe.

This strategic pivot by EOS not only underscores the growing importance of Europe’s defence market but also signals a broader trend of defence companies seeking to align themselves with regional security priorities. As European nations strive to enhance their sovereign capabilities, partnerships with innovative firms like EOS will be crucial in shaping the future of defence technology.