Nigeria’s Terra Industries, a burgeoning defence technology startup, has secured $11.75 million in seed funding, a milestone that resonates far beyond the balance sheet. The investment round, led by Silicon Valley venture firm 8VC—founded by Palantir co-founder Joe Lonsdale—also included global and African investors such as Valour Equity Partners, Lux Capital, SV Angel, Nova Global, Tofino Capital, Kaleo Ventures, and DFS Lab. This influx of capital is not just a vote of confidence in Terra Industries but a testament to the growing potential of Africa’s defence tech ecosystem.

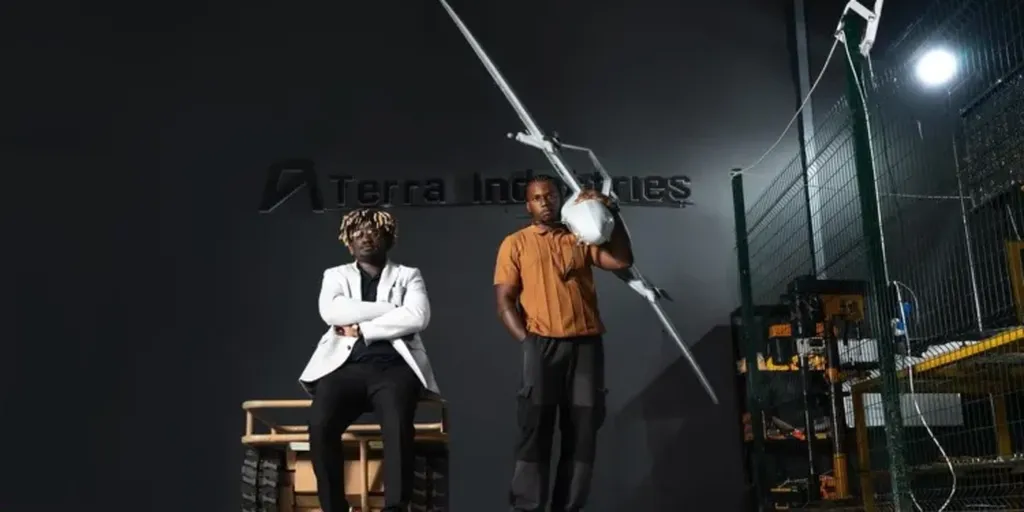

Founded in Abuja by young engineers Nathan Nwachuku and Maxwell Maduka, Terra Industries has developed a cutting-edge technology platform that integrates autonomous drones, robotic ground systems, and fixed monitoring towers to safeguard critical infrastructure across land and air. The participation of globally recognised investors, particularly those with deep roots in the defence and technology sectors, underscores a significant shift in perception: African startups are now seen as capable of building advanced hardware and software platforms, even in sectors traditionally dominated by foreign firms.

“This is part of a broader shift where Nigeria’s engineering talent is increasingly trusted not just to use technology, but to create and scale it for global relevance,” said Maxwell Maduka, co-founder of Terra Industries.

Scaling Beyond Borders: Manufacturing and Innovation on the Continent

Unlike many startups that outsource hardware production, Terra Industries is committed to keeping manufacturing on the continent. The company plans to expand its 15,000-square-foot facility in Abuja and establish additional defence production facilities, while also growing its software and AI teams. This strategy has several profound implications:

Jobs and Skills Development: By maintaining a local manufacturing footprint, Terra Industries is creating high-tech jobs—from mechanical and aerospace engineers to AI and robotics developers—right in Africa. This not only boosts the local economy but also fosters a new generation of skilled professionals.

Localised Solutions: Technology tailored for Africa’s unique security challenges, such as rugged terrain and diverse threat landscapes, is often more effective than off-the-shelf imports. Terra’s solutions are designed to address these specific needs, ensuring better protection and reliability.

Export Potential: As infrastructure protection becomes a continental priority, Terra’s systems could emerge as an African export, not just a domestic product. This could position Nigeria—and Africa—as a hub for advanced defence technology.

Hard Tech is Emerging as a Frontier for African Tech Investment

Much of Africa’s startup narrative has focused on fintech, e-commerce, and digital services. Terra’s funding indicates that “hard tech”—robotics, defence systems, autonomous platforms—is now attracting serious capital. Securing tens of millions at the seed stage is rare in regions outside Silicon Valley, especially for hardware-centric companies. By landing funding from major global players, Terra is helping broaden the types of tech that investors see when they think “African innovation.”

“This lowers barriers for other deep-tech founders across the continent, potentially creating a new class of high-growth African tech companies,” said Joe Lonsdale, founder of 8VC.

Security and Infrastructure Protection as Economic Enablers

Terra’s solutions are already deployed at critical infrastructure sites, including power plants and mining operations, securing assets worth billions of dollars across Africa. In regions where industrial projects are frequently disrupted by militant activity, vandalism, and theft, the lack of reliable security infrastructure can deter investment and escalate operational costs. Terra’s autonomous monitoring systems offer a robust solution:

Energy and utilities become safer investments.

Mining and extractive industries can operate with improved continuity.

Governments have an alternative to importing expensive defence systems.

Advancing a More Sovereign Security Tech Stack

Terra’s ambition mirrors global trends where countries aim to own and control key security technologies rather than depend on foreign suppliers. The company’s vision of a vertically integrated defence platform—encompassing hardware, software, and data under one roof—mirrors what established firms like Palantir and Anduril are doing in the U.S. For Africa, this kind of sovereign technology stack offers strategic advantages:

The data generated on African soil stays under local governance.

Deployment can be customised for local threat profiles.

Defence tech doesn’t become an import liability.

Potential Ripple Effects Across the Tech Ecosystem

Terra’s funding could create spillovers beyond the defence sector. As the company expands its software and AI teams, it will require next-level engineering talent, pushing up demand for training and specialised education. Success stories like Terra can help form clusters, where startups, investors, universities, and policymakers converge to build ecosystems. More funding attention may flow to adjacent sectors like autonomous logistics, precision agriculture drones, or smart infrastructure monitoring.

In essence, Terra Industries’ $11.75 million funding is more than a capital event; it is a signal of mat