Israel’s defense establishment and its hi-tech sector have always been intertwined, but the past two years have transformed that relationship into something far more profound. What was once a pipeline of veterans from elite units like 8200 founding cybersecurity start-ups has evolved into a full-scale defense-tech ecosystem, one that is expanding at a pace unmatched anywhere in the world.

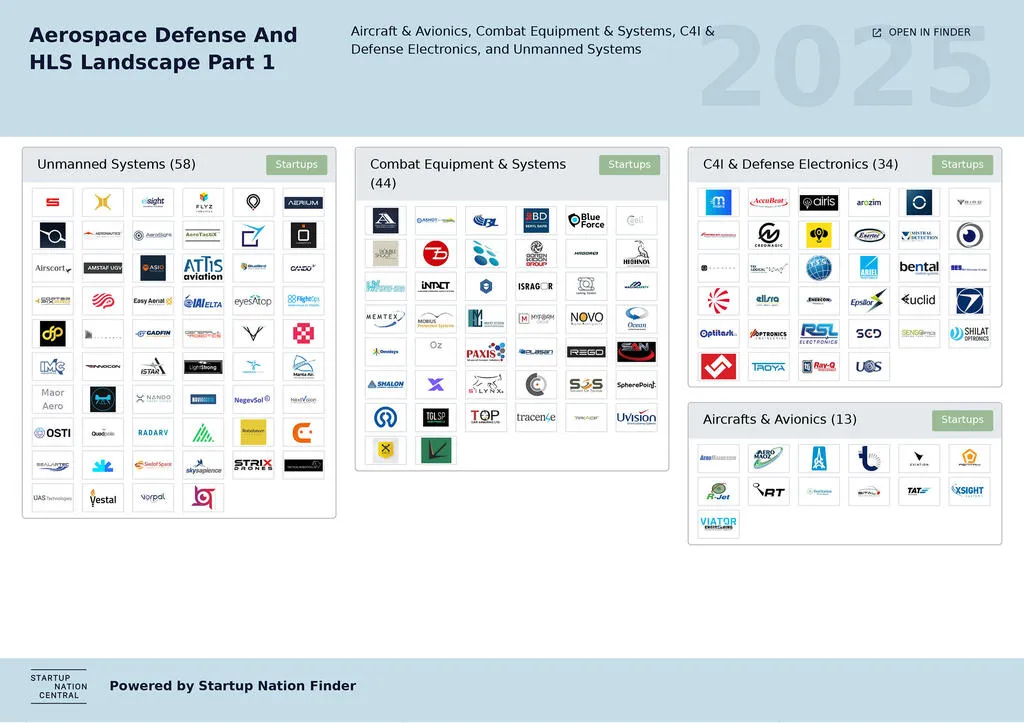

Israel has spent the last two years fighting in Gaza, Lebanon, Yemen, and even Iran. And while the war has been highly controversial, it has also been a proving ground for new groundbreaking technologies, many of which are the brainchildren of veterans returning from the battlefields with firsthand knowledge of what warfighters need. These veterans, many of whom have also spent years in the industry, have founded new defense-tech companies. According to recent industry mapping, Israel’s defense-tech sector has nearly doubled in size since October 7, growing from roughly 160 companies in 2024 to more than 300 active start-ups today.

For a country already known as the Start-Up Nation, the surge is striking, and for the defense establishment, it is becoming indispensable. Israel, many experts are arguing, is becoming the Defense-Tech Nation.

At SNC, we began mapping the Israeli defense-tech sector about 18 months ago. At the time, we identified around 150 companies. Today, that number is close to 350. That’s tremendous growth. Part of it comes from new start-ups, and part from existing companies repositioning themselves as dual-use. Historically, dual-use meant defense first, then civilian. Now it’s the opposite: civilian and commercial companies are adding a defense angle,” Hasson explained.

The shift began with wartime urgency, after October 7 made the country’s vulnerabilities devastatingly clear. As the IDF confronted simultaneous threats from rockets, ballistic missiles, and unmanned aerial vehicles (UAVs) from various fronts, warfighters increasingly turned to civilian innovators for rapid, field-ready solutions. What started as ad hoc cooperation with no playbook has since become formalized, strategic partnerships.

According to Hasson, the connection between start-ups and the defense sector is actually quite new. “For many years, defense companies were seen strictly as primes, and venture capital simply wouldn’t go near defense,” he explained. “But over the past decade, we’ve seen the rise of VC-backed defense companies in the US, like Palantir and Anduril, and it’s no surprise that Israel is now catching up and even punching above its weight.”

Senior defense and industry officials have described to D&T a new model in which start-ups are embedded early in operational planning, providing tools that can be tested, iterated, and deployed in real time. One source told D&T that of the hundreds of start-ups that were founded over the past two years, many of them have fielded and proved their solutions on the battlefield. And not only has the R&D cycle shortened, many of the concept-to-combat integration processes have accelerated from 800 days to just 80.

“For years, Israel was known worldwide as a cyber nation. Today, we have evolved into a true defense-tech nation,” said Defense Ministry Director-General Amir Baram at the Defense Tech Week conference in early December. “Tel Aviv now ranks as the world’s third leading defense-tech hub.”

Recognizing the strategic importance of this ecosystem, the Israeli government recently launched a state-backed investment initiative aimed at strengthening early-stage defense-tech ventures. The Defense Ministry has also invested NIS 1.2 billion in start-ups alone, and small and medium-sized companies have signed contracts worth hundreds of millions each.

Last January, the IDF and the ministry opened a Directorate for AI and Autonomy aimed at spearheading research, development, and force-building in AI and autonomous systems across the military. The goals are not only to accelerate innovation but to ensure Israel maintains technological independence in critical domains, because global supply-chain disruptions and shifting geopolitical alliances are reminders that Israel cannot rely solely on foreign suppliers for key defense capabilities.

According to Baram, in 2024 alone, 21 government-to-government agreements were worth billions of shekels, with major defense companies signing “significant” contracts in Europe, Asia, and North America. According to Hasson, while defense ministries and government agencies are pushing for new policies and procurement reforms, “they still trust their prime contractors, but they can’t wait 15 years for new technology. Start-ups are nimble, innovative, and can deliver solutions now.”

“Last year, total investment in Israeli defense tech was under $180 million. This year, it reached $440m, and most of it came from American investors. The world’s best investors are paying attention to Israeli companies. We’ve always had the right