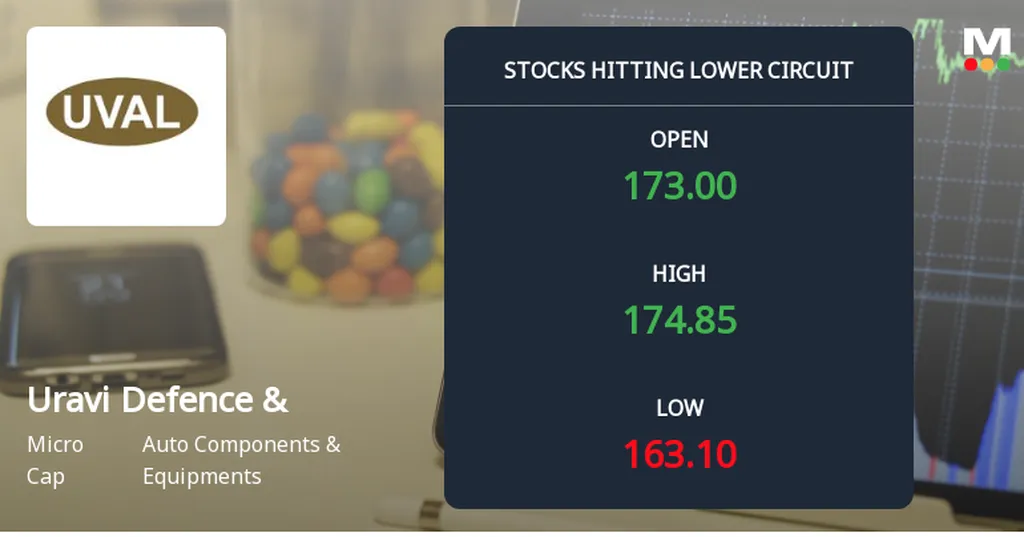

Uravi Defence & Technology’s stock experienced a significant downturn on 29 December 2025, marking a notable shift in market sentiment and investor confidence. The stock touched an intraday low of ₹207.57, a 5.0% drop from its previous close, while its highest price during the session was ₹219.79, reflecting a wide trading range of over ₹12. The weighted average price for the day leaned towards the lower end of the spectrum, indicating that the majority of trades occurred near the day’s low. The total traded volume was approximately 5,672 shares, with a turnover of ₹0.12 crore. Despite the relatively modest volume, the stock’s liquidity was sufficient to handle trades up to ₹0.01 crore based on 2% of the five-day average traded value, suggesting that the selling pressure was concentrated but impactful.

The stock’s performance underperformed its sector peers significantly. The Auto Components & Equipments sector recorded a marginal decline of 0.18%, while the broader Sensex index showed a slight positive return of 0.11%. This divergence highlights the stock-specific nature of the sell-off, rather than a broad market or sector-wide downturn. The fall ended a 12-day streak of consecutive gains, signalling a potential shift in market assessment and investor confidence. This reversal may be attributed to profit-booking or emerging concerns about the company’s near-term prospects.

From a technical standpoint, Uravi Defence & Technology’s last traded price (LTP) of ₹207.57 remains above its 5-day, 20-day, and 50-day moving averages, indicating some short-term support. However, it is still below the 100-day and 200-day moving averages, which may suggest longer-term resistance levels are in place. This mixed technical picture could be contributing to the cautious stance among traders and investors. Investor participation has shown signs of rising interest, with delivery volumes on 26 December reaching 15,360 shares, a 62.73% increase compared to the five-day average delivery volume. This heightened activity may have set the stage for the recent volatility and the subsequent sharp price correction.

The stock’s plunge to the lower circuit limit reflects a scenario of unfilled supply, where sell orders overwhelmed buy orders, triggering automatic trading halts to prevent further declines. Such circuit breakers are designed to curb panic selling and provide a cooling-off period for the market to stabilise. In the case of Uravi Defence & Technology, the maximum permissible daily loss of 5.0% was reached, underscoring the intensity of the selling pressure. Market participants appeared to react swiftly to recent developments or shifts in analytical perspectives, leading to a rapid exit from positions.

Uravi Defence & Technology Ltd operates within the Auto Components & Equipments industry, catering to specialised segments that may include defence-related technologies and automotive equipment. The company is classified as a micro-cap entity with a market capitalisation of approximately ₹236.63 crore, which often entails higher volatility and sensitivity to market news compared to larger, more established firms. Given its size and sector, the stock’s liquidity and trading volumes tend to be lower, which can exacerbate price movements when significant sell orders emerge. Investors should be mindful of these factors when analysing the stock’s recent price behaviour.

The sharp decline and circuit hit in Uravi Defence & Technology’s shares serve as a cautionary signal for investors. The stock’s recent trend reversal after nearly two weeks of gains suggests that market participants are reassessing the company’s prospects amid evolving conditions. While the stock remains technically supported by short-term moving averages, the unfilled supply and panic selling indicate a fragile market sentiment. Investors should closely monitor upcoming corporate announcements, sector developments, and broader market trends before making fresh commitments. Given the micro-cap status and sector-specific risks, volatility is likely to persist in the near term. Prudent risk management and diversification remain essential for those holding or considering exposure to Uravi Defence & Technology.

In summary, Uravi Defence & Technology’s stock experienced a significant setback on 29 December 2025, hitting the lower circuit limit with a 5.0% loss amid heavy selling pressure and unfilled supply. The stock’s underperformance relative to its sector and the broader market, combined with technical and liquidity factors, underscores the challenges faced by investors in this micro-cap Auto Components & Equipments company. Market participants are advised to stay informed and exercise caution as the situation develops.