Uravi Defence & Technology Ltd has been assigned a ‘Strong Sell’ rating, a cautionary signal for investors indicating that the stock is expected to underperform relative to the broader market. This assessment is based on a comprehensive evaluation of four key parameters: Quality, Valuation, Financial Trend, and Technicals, each contributing to the overall investment outlook as of 25 December 2025.

Quality Assessment

As of 25 December 2025, Uravi Defence & Technology Ltd exhibits below-average quality metrics. The company has demonstrated weak long-term fundamental strength, with a compounded annual growth rate (CAGR) of operating profits declining by 12.62% over the past five years. This negative growth trend highlights challenges in sustaining profitability and operational efficiency. The average Return on Equity (ROE) stands at a modest 4.60%, indicating limited profitability generated per unit of shareholders’ funds. Additionally, the firm’s ability to service its debt is constrained, with a high Debt to EBITDA ratio of 4.22 times, indicating elevated leverage and potential financial risk.

Valuation Considerations

The valuation of Uravi Defence & Technology Ltd is currently assessed as very expensive relative to its capital employed. The company’s Return on Capital Employed (ROCE) is 3.6%, while the Enterprise Value to Capital Employed ratio also stands at 3.6, suggesting that investors are paying a premium for the capital base despite subdued returns. Although the stock trades at a discount compared to its peers’ average historical valuations, this does not offset concerns about its fundamental performance. The valuation metrics imply that the market may be pricing in expectations that are not fully supported by the company’s current financial health.

Financial Trend and Recent Performance

Financially, the company’s trend is largely flat, with limited growth in profitability. The latest quarterly results ending September 2025 reveal subdued operational performance, with PBDIT (Profit Before Depreciation, Interest and Taxes) at a low ₹0.62 crore and operating profit to net sales ratio at a mere 5.14%. The Profit Before Tax (PBT) excluding other income was negative at ₹-0.24 crore, underscoring ongoing challenges in generating positive earnings. Over the past year, the stock has delivered a return of -50.00%, reflecting significant investor losses. Despite this, profits have marginally increased by 0.6%, indicating a lack of meaningful improvement in the company’s financial trajectory.

Technical Analysis

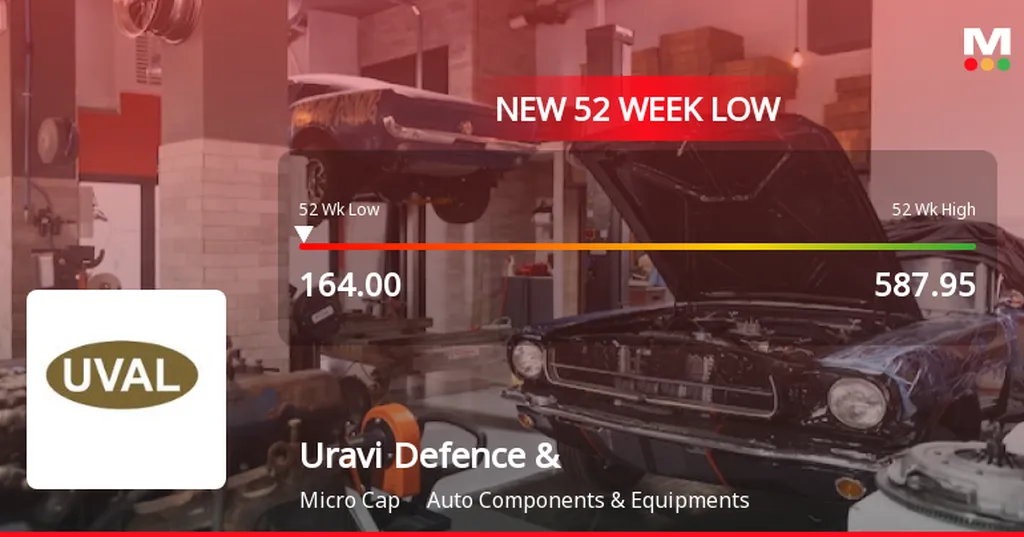

The technical grade for Uravi Defence & Technology Ltd is mildly bearish as of 25 December 2025. This suggests that the stock’s price momentum and chart patterns are not favourable for short-term gains. Despite a positive one-day change of 4.97% and a one-week gain of 24.46%, the stock has experienced significant declines over longer periods, including a 58.22% drop over six months and a 50.02% loss year-to-date. These mixed signals highlight volatility and uncertainty in the stock’s price movements, which may deter risk-averse investors.

Additional Considerations: Promoter Confidence and Market Position

Investor sentiment is further dampened by a reduction in promoter confidence. Promoters have decreased their stake by 11.91% in the previous quarter, now holding 58.39% of the company. Such a decline in promoter holding often signals concerns about the company’s future prospects. Furthermore, Uravi Defence & Technology Ltd has underperformed the BSE500 index over the last three years, one year, and three months, reinforcing its position as a laggard within the broader market.

Implications for Investors

For investors, the ‘Strong Sell’ rating serves as a cautionary indicator. It reflects the combination of weak fundamentals, expensive valuation, flat financial trends, and bearish technical signals. While the stock may present occasional short-term rallies, the overall outlook suggests that it is likely to continue underperforming relative to peers and market benchmarks. Investors should carefully consider these factors and their risk tolerance before allocating capital to Uravi Defence & Technology Ltd.

Summary

In summary, Uravi Defence & Technology Ltd’s current ‘Strong Sell’ rating by MarketsMOJO, last updated on 13 August 2025, is grounded in its present-day financial and market realities as of 25 December 2025. The company faces significant headwinds in quality, valuation, financial performance, and technical outlook. Investors should approach this stock with caution, recognising the risks inherent in its current profile and the likelihood of continued underperformance in the near to medium term.

Only Rs. 9,999 –