The UK defence industry is a cornerstone of the nation’s economy, and its growth trajectory is poised to accelerate in the coming years. The Joint Economic Data (JED) Hub’s 2025 Annual Economic Report, “Capturing and quantifying the contribution of the defence sector to the UK economy,” provides a comprehensive analysis of this dynamic sector. Based on data from the 2024 JEDHub Industry Survey, which included responses from 16 of the UK’s largest defence firms such as BAE Systems, Rolls-Royce, and Qinetiq, the report offers a detailed snapshot of the industry’s performance during 2022 and 2023.

Employment Trends

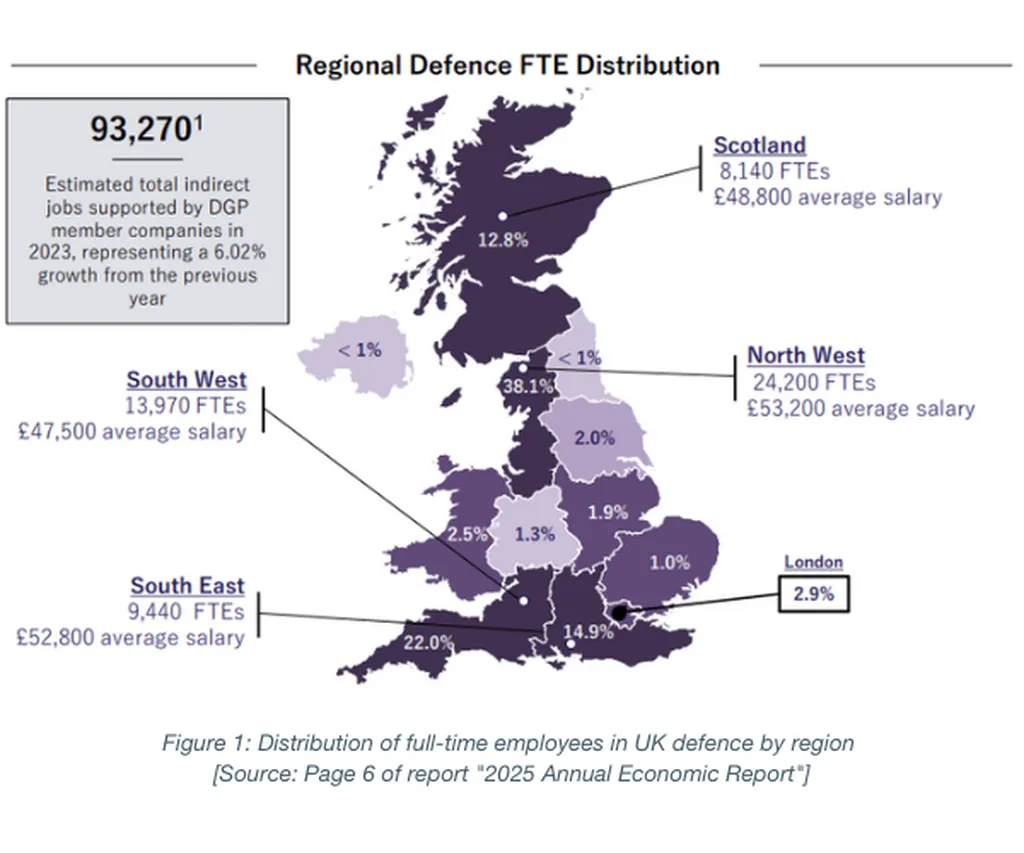

The report highlights significant employment growth within the defence sector. According to the survey, the North West region is the largest employer, with 24,200 full-time employees, followed by the South East with 9,440 employees. This distribution underscores the North West’s growing importance in the UK defence landscape, home to several major defence contractors. The report also notes a 19.9% increase in employee numbers between 2022 and 2023, reflecting the sector’s expanding footprint and its critical role in national security.

Revenue and Market Dynamics

Revenue figures paint an equally robust picture. The report reveals that total revenue increased from £28.9 billion in 2022 to £33.2 billion in 2023, marking a 15% rise. This growth is accompanied by a substantial increase in expenditure on intermediate goods and services, which surged by over 30%, possibly indicating ongoing cost pressures within the supply chain.

International and domestic markets both contributed to this growth. International revenues rose from £7.7 billion in 2022 to £8.2 billion in 2023, with the Middle East remaining the largest contributor, although it saw a slight decline of about 5%. Exports to North America and Europe grew by 6% and approximately 15%, respectively. Domestic defence turnover also increased by 15%, with the UK Ministry of Defence (MoD) being the largest customer, accounting for £14 billion in sales. Other government departments and business-to-business sales added another £2 billion to the domestic turnover.

Technology and Capability Areas

The report delves into the revenue generated by different technology areas, revealing that combat air turnover leads with a 37% share, contributing £7.7 billion. Notably, 67% of combat air sales are international, highlighting the UK’s strong reputation in air combat technologies. Sub-surface maritime technologies also play a significant role, contributing 18% or £4.4 billion, with almost all revenue coming from domestic sources. The report suggests that these areas will continue to see growth, particularly with advancements in drone technologies and increasing global demand for maritime security solutions.

Research and Development

Research and Development (R&D) expenditure is a critical indicator of the industry’s innovation capabilities. The report shows a clear upward trend in R&D spending from 2021 to 2023, with defence R&D expenditure increasing significantly each year. The UK Government is a major funding source, contributing around 63% of the total R&D expenditure, followed by the companies’ own funds (21%), overseas sources (10%), and other UK businesses (5%).

When broken down by technology area, air technologies dominate R&D spending, accounting for 61% of the total. Maritime and land technologies each have a roughly equal share of around 14%, while space and cyber technologies receive 7% and 3%, respectively. The report anticipates continued growth in air technologies and an increasing focus on space and cyber defence technologies in the future.

Conclusion

The 2025 Annual Economic Report by the Joint Economic Data Hub presents an optimistic outlook for the UK defence industry. The sector is not only a significant employer and revenue generator but also a hub of innovation, driven by substantial R&D investments. As geopolitical uncertainties persist, the UK defence industry is poised to play an even more critical role in national security and economic stability. For businesses operating in this sector, protecting their innovations through patent applications and other intellectual property measures will be essential to maintaining their competitive edge.