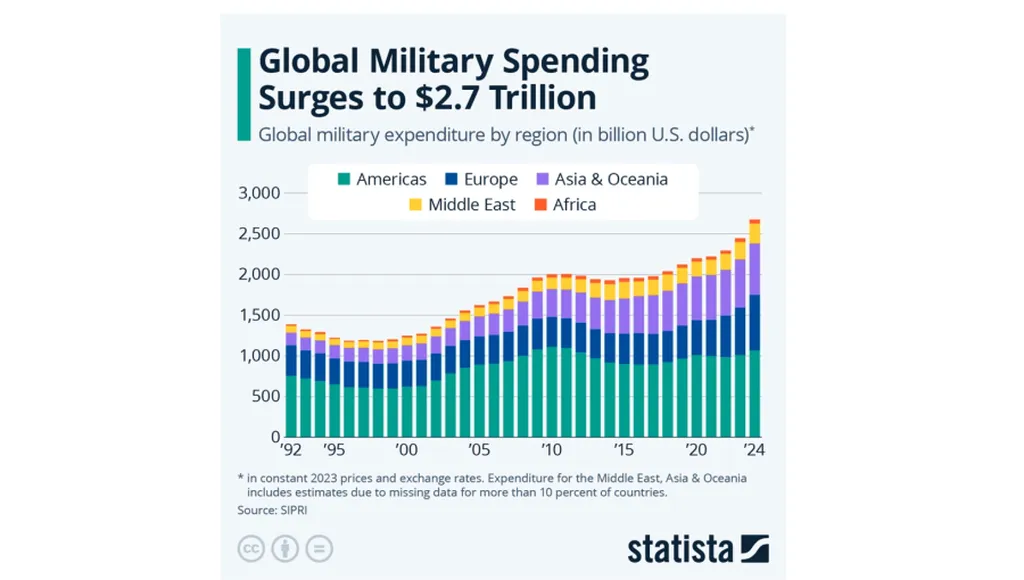

Defence spending is surging globally, and the ripple effects are being felt across stock markets, boardrooms, and battlefields. As geopolitical tensions escalate from Eastern Europe to the Middle East and the Asia-Pacific, governments are prioritising preparedness over peace dividends. Global defence expenditure reached a staggering US$2.5 trillion in 2024, marking the most significant increase since the Cold War. Analysts predict this figure could rise to 3.5% of global GDP by 2030, as nations view defence not just as a necessity but as a catalyst for job creation and technological innovation.

The defence sector has become one of the most dynamic investment themes of the year. Defence Exchange-Traded Funds (ETFs) and tech stocks linked to national security are attracting significant investor interest. However, this isn’t a traditional arms race; the focus has shifted from conventional warfare to digital and technological superiority.

Australian defence stocks are landing major deals, reflecting the global trend. DroneShield (ASX:DRO), a leader in counter-drone technology, has secured a $25.3 million contract in Latin America. This deal underscores the growing importance of drone defence systems, with DroneShield’s technology being used to detect, track, and neutralise hostile unmanned aerial vehicles (UAVs) in real time. The contract is the company’s eighth repeat order from the same regional partner, highlighting the increasing demand for counter-UAS technology.

Austal (ASX:ASB), a prominent shipbuilder, has been appointed Design Authority for the Navy’s next-generation Landing Craft Medium under a $15 million agreement. This contract positions Austal as a key player in shaping Australia’s naval capabilities, reinforcing the company’s role in the defence sector.

The rise of digital frontliners is another critical aspect of the defence sector’s evolution. Modern militaries require real-time intelligence and secure communication systems to maintain an edge in an increasingly complex threat landscape. Harvest Technology Group (ASX:HTG), based in Perth, is at the forefront of this digital transformation. The company develops technology that enables secure, high-definition video and data transmission from anywhere on Earth, even in low-bandwidth environments.

Harvest’s proprietary Nodestream platform is designed for hostile conditions where traditional networks fail. The platform’s applications, including Nano, Rugged, and Flex, handle multi-channel video and data streaming with high fidelity. This technology is already being deployed for border security in the Middle East and in the resources sector, demonstrating its versatility and adaptability.

In October, Harvest inked a deal with government supplier Annex Digital, combining its encrypted streaming platform with Annex’s public-sector reach to target defence and national security tenders. “By combining our technical innovation with Annex’s established presence in the public-sector digital ecosystem, we are well positioned to deliver high-value, sovereign technology solutions,” said Harvest CEO, Ilario Faenza.

Harvest has spent FY25 streamlining operations, cutting losses, and securing fresh funding to fuel growth. With former Major General Jeff Sengelman now in the chair, the company has a direct line into the defence world it serves. Its next big play is Project NEON, an AI-driven edge computing platform designed to work alongside Nodestream, enabling autonomous systems to analyse and act even when cloud links go down.

The market may label this sector as “defence,” but what’s unfolding is a full-scale rewrite of how we move data, secure it, and automate the edge. These capabilities are increasingly being adopted in mining, infrastructure, and offshore operations, where uptime is critical, and budgets are substantial. For investors, this isn’t just a war thematic; it’s a technology trade with far wider upside. With governments spending heavily and industry demanding the same tech, Australia’s defence innovators like Harvest could be on the cusp of their best growth window in years.